More About Eb5 Investment Immigration

More About Eb5 Investment Immigration

Blog Article

Get This Report on Eb5 Investment Immigration

Table of ContentsThe Eb5 Investment Immigration StatementsNot known Factual Statements About Eb5 Investment Immigration Some Ideas on Eb5 Investment Immigration You Should KnowThe Facts About Eb5 Investment Immigration UncoveredSome Known Incorrect Statements About Eb5 Investment Immigration

While we strive to provide exact and current material, it needs to not be considered legal advice. Migration legislations and policies undergo transform, and individual scenarios can differ widely. For customized guidance and legal recommendations concerning your specific migration scenario, we strongly suggest seeking advice from with a certified immigration attorney who can give you with customized assistance and make sure conformity with current laws and regulations.

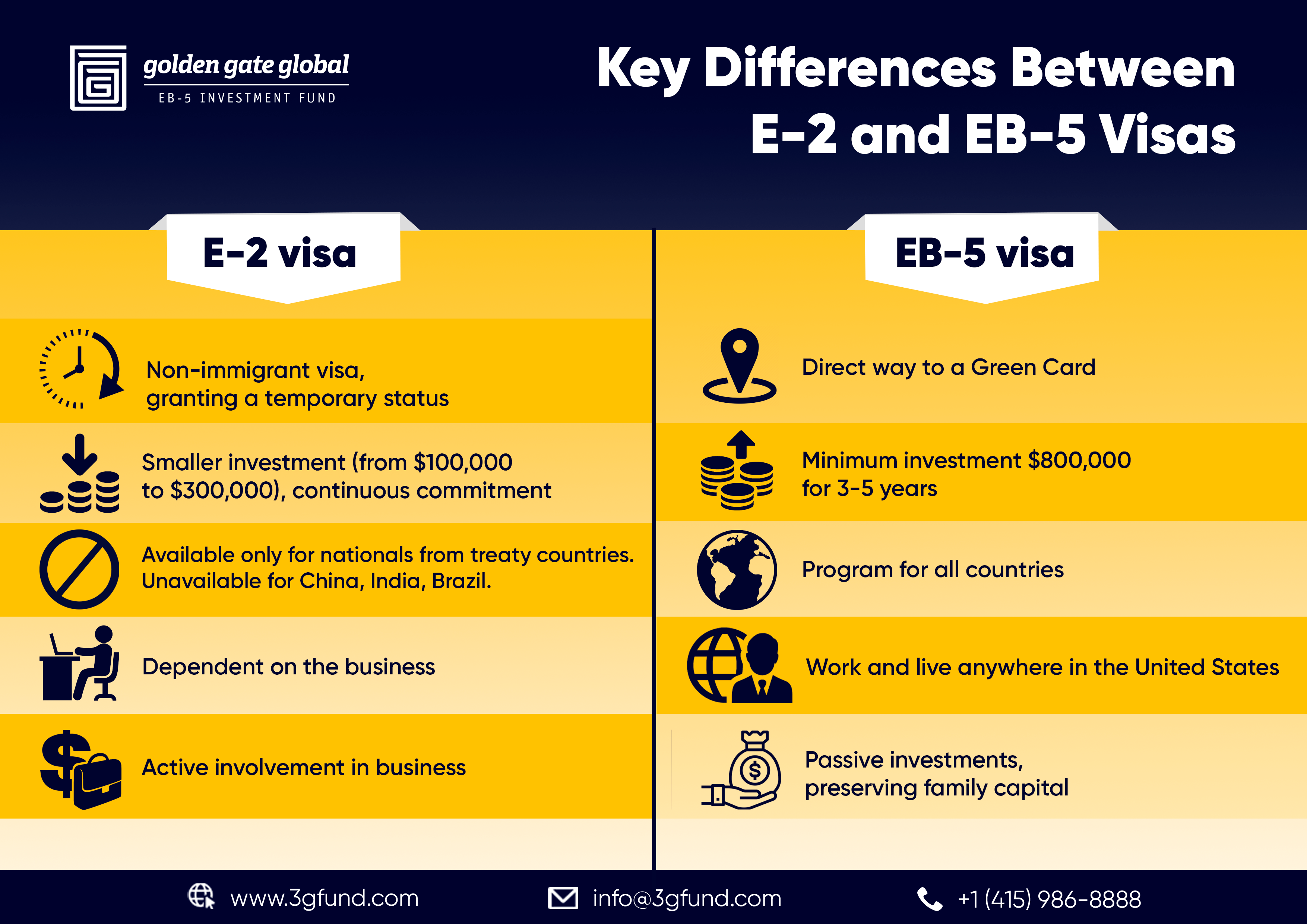

Citizenship, through financial investment. Currently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Work Areas and Country Locations) and $1,050,000 in other places (non-TEA zones). Congress has actually accepted these quantities for the following 5 years beginning March 15, 2022.

To qualify for the EB-5 Visa, Financiers have to develop 10 full-time U.S. jobs within two years from the day of their full investment. EB5 Investment Immigration. This EB-5 Visa Need guarantees that financial investments contribute directly to the united state work market. This uses whether the tasks are produced straight by the industrial enterprise or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

Some Known Details About Eb5 Investment Immigration

These work are determined through designs that make use of inputs such as development expenses (e.g., construction and equipment expenditures) or yearly incomes generated by recurring procedures. On the other hand, under the standalone, or direct, EB-5 Program, only direct, full time W-2 employee settings within the company might be counted. A key danger of counting exclusively on direct employees is that staff decreases due to market conditions can lead to inadequate full time placements, potentially causing USCIS rejection of the financier's petition if the work production requirement is not met.

The financial model after that projects the number of direct jobs the new business is most likely to develop based upon its anticipated revenues. Indirect jobs determined with financial models describes employment produced in sectors that supply the goods or solutions to business straight entailed in the job. These jobs are created as an outcome of the enhanced demand for items, materials, or services that sustain the service's operations.

The Eb5 Investment Immigration Statements

An employment-based 5th choice useful reference classification (EB-5) financial investment visa gives a method of becoming a permanent U.S. local for foreign nationals intending to spend resources in the United States. In order to obtain this eco-friendly card, a foreign investor needs to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and create or preserve at least 10 full time work for United States employees (omitting the financier and their instant family members).

Today, 95% of all EB-5 visit this page resources is raised and invested by Regional Centers. In several regions, EB-5 financial investments have actually filled the funding space, providing a new, important resource of resources for regional financial advancement projects that revitalize communities, develop and support work, facilities, and services.

About Eb5 Investment Immigration

More than 25 countries, including Australia and the United Kingdom, use comparable programs to draw in foreign investments. The American program is a lot more stringent than several others, needing significant danger for investors in terms of both their monetary investment and immigration status.

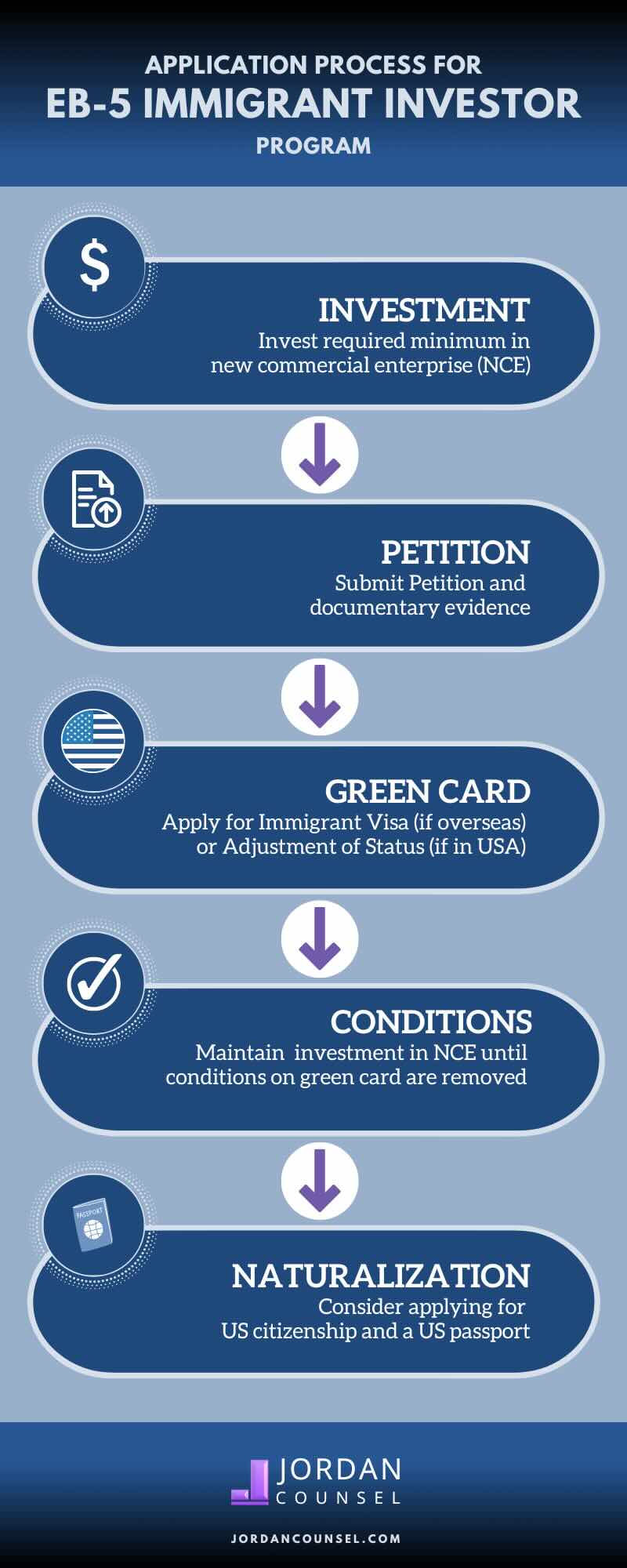

Families and people who seek to move to the United States on a permanent basis can apply for the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Services (U.S.C.I.S.) established out numerous demands to obtain permanent residency through the EB-5 visa program.: The initial action is to discover a qualifying investment chance.

As soon as the possibility has been identified, the financier should make the financial investment and submit an I-526 petition to the U.S. Citizenship and Migration Solutions (USCIS). This request should include evidence of the financial investment, such as bank declarations, purchase agreements, and business strategies. The USCIS will examine the I-526 petition and either authorize it or request added evidence.

More About Eb5 Investment Immigration

The capitalist click to investigate must request conditional residency by sending an I-485 petition. This request needs to be sent within six months of the I-526 approval and must include evidence that the financial investment was made which it has actually developed at the very least 10 full-time jobs for U.S. employees. The USCIS will certainly examine the I-485 petition and either accept it or demand additional evidence.

Report this page